How To Remove Late Mortgage Payments From Credit Report

And standard lenders are a few of the most inflexible. Three Ways You Can Remove Late Payments from your Credit Report 1.

How To Remove Late Payments From Your Credit Report

There is no law that requires or mandates reporting.

How to remove late mortgage payments from credit report. And remember Credit Bureau disputes will not work for late payments unless the late occurred over 4 years ago on a closed account. Its also worth noting that even if youre on time with child support payments having to pay child support can make it more difficult for you to get approved for a mortgage or other loan. Fortunately though you can take steps to.

Since no laws says that account information has to be reported and for what period then Ill challenge every reporting of information on my credit report. A goodwill letter is your attempt to convince credit card companies mortgage lenders and other lenders to remove a late or missed payment from your credit reports. For example if you have been late in making mortgage payments and you have a history of paying late then there is a good chance that the information is not correct.

You can request the change in two ways. The simplest approach is to just ask your lender to take the late payment off your credit report. Unless youre a victim of fraud and or identity theft the only way to remove a recent late payment from the credit report is by getting the original creditor to agree to remove the late payment.

Your credit report contains inaccurate information associated with your foreclosure. Once you miss a child support payment that late payment can be reported to the credit bureaus and can remain on your credit report for seven years. If you have a valid reason provide your lender with an explanation.

When 7 years have passed and the Bureaus remove accounts and late payments then accurate information has been removed from your credit. You may be able to remove late payments on your credit reports and start to improve your credit with a goodwill letter A goodwill letter. Call your lender and ask if the lender will remove the 30-day late payment from your record.

A wide array of creditors including mortgage lenders and credit card issuers are offering temporary payment relief during the pandemic. One possible solution. A late mortgage payment could stay on your credit report for up to seven years.

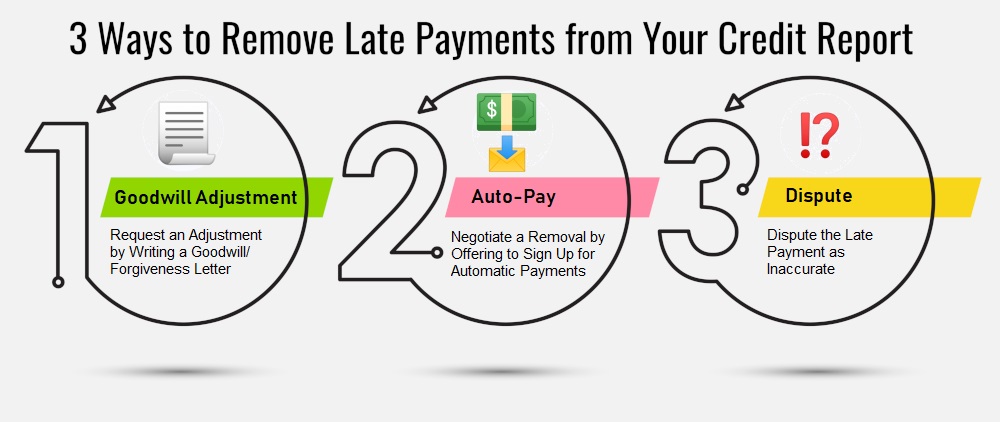

If youre among them theres a good chance your lenders are prepared to work with you to provide payment relief without causing late payments to appear on your credit reports. Request a Goodwill Adjustment from the Creditor Negotiate to Remove a Late Payment by Signing Up for Auto-Pay Dispute the Late Payment Entry on Your Credit Report as Inaccurate. It happenedyouve missed a mortgage payment.

If this satisfies them they are more likely to remove the late payment from your record if you dont have a history of late payments. A missed mortgage payment isnt the end of the world but there are repercussions to keep in mind including credit score harm. How To Remove Late Payments From Your Credit Report 2020 Guide For Free In 10 Minutes Enjoy more explained videos relevant with Can Credit History Be Erased.

Your Credit Repair Clever Tips Techniques And FaqS Not all how to Improve Credit Score strategies are equivalent. Dispute the Late Payment with the Creditor Disputing a late payment with the bank or creditor directly is often the most effective. Maybe because the due date slipped your mind or youre in a rough spot financially.

Here are 3 proven ways to remove late payments from your credit report. That should remove the information at the source so that it wont come back later. This can affect your credit scores in several ways.

/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif)

How To Remove Late Payments From Your Credit Reports

How To Remove Late Payments From Your Credit Reports

Sample Goodwill Letter To Remove Late Payments From Your Credit Report Credit Report How To Fix Credit Credit Repair Companies

/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif)

How To Remove Late Payments From Your Credit Reports

Goodwill Letter Sample 2021 Remove Late Payments From Credit Report

4 Ways To Get Late Payments Removed From Your Credit Report Credit Repair Letters Paying Off Credit Cards Credit Repair

How To Remove Late Payments From Your Credit Report Credit Repair Letters Credit Repair Companies Credit Report Repair

4 Ways To Get Late Payments Removed From Your Credit Report Credit Repair My Credit Score How To Fix Credit

Ever Wondered How To Remove The Late Payment History Homesforsale Newhome Realtor Realestate Dreamhome Credit Repair Improve Credit Score Improve Credit

How To Remove Late Payments From Your Credit Report 2021 Badcredit Org

How To Remove Late Payments From Your Credit Report 2021 S Guide

Credit Dispute Letter Template Credit Repair Secrets Exposed Good Credit Credit Repair Credit Card Infographic

Remove Late Payments In 3 Steps From Credit Reports 2020 Guide

How To Remove Late Payments From Your Credit Report Improve Credit Score Improve Credit Credit Bureaus

How To Remove Late Payments From Your Credit Report How To Remove Credit Report Payment

Remove Late Payments In 3 Steps From Credit Reports 2020 Guide

Repair Your Credit Report With A Goodwill Letter Check Credit Score Credit Repair Credit Card Website

/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif)

How To Remove Late Payments From Your Credit Reports

Remove Late Payments An Example Goodwill Letter For Credit Card Accounts Credit Card Credit Card Account How To Remove

Post a Comment for "How To Remove Late Mortgage Payments From Credit Report"